AI Use Cases In the Lending Industry: 7 Ways How AI Can Transform The Lending Industry

We've revealed the tremendous influence of AI Use Cases In the Lending Industry by utilizing the before-and-after bridge content strategy structure

Introduction

- The loan sector, a cornerstone of economic activity, is undergoing a significant revolution driven by the incorporation of cutting-edge technology, notably Artificial Intelligence (AI). Traditionally defined by laborious procedures, inflexible habits, and occasionally bureaucratic inefficiencies, the lending environment is now on the verge of a dramatic shift.

- Furthermore, AI is tackling a long-standing issue in lending—human prejudice. Historically, loan choices have been prone to conscious or unconscious prejudice. When trained on diverse and inclusive datasets, AI decreases the influence of biases in decision-making, promoting justice and equal opportunity for all candidates. In this blog, we will explore AI use cases in the lending industry with it's real-life examples.

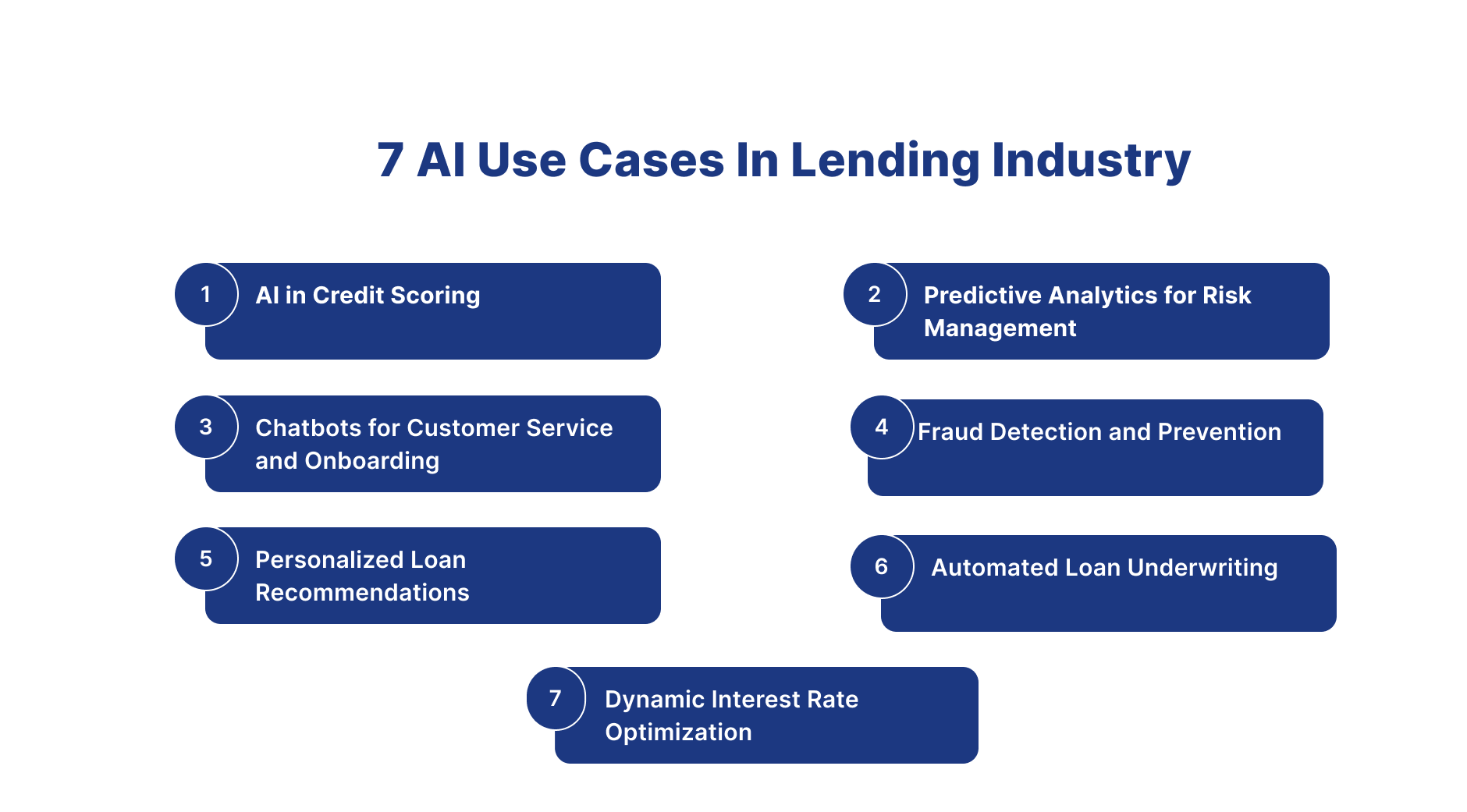

- 7 AI Use Cases In Lending Industry

1. AI in Credit Scoring

- Credit scoring has traditionally depended on a narrow collection of criteria, resulting in a one-size-fits-all approach. Conversely, AI has upended this paradigm by utilizing To examine a dataset, machine learning techniques are utilised. broad variety of data points. AI-driven credit scoring algorithms enable a more thorough and nuanced appraisal of an individual's creditworthiness, using traditional credit histories and non-traditional characteristics such as social media behavior and internet activity. This improves accuracy and allows persons with minimal credit histories to obtain financial services. This can be an AI use cases in the lending industry.

- ZestFinance, a fintech business, uses AI algorithms to analyze data points other than standard credit scores. ZestFinance seeks to give more accurate and inclusive credit evaluations by including unorthodox criteria such as online behaviour and social media presence, allowing persons with minimal credit histories to acquire loans.

2. Predictive Analytics for Risk Management

-

The predictive analytics capabilities of AI have proven helpful in risk management for lenders. AI systems can detect possible hazards connected with loan choices by analyzing past data and recognizing patterns. This proactive strategy enables financial institutions to optimize risk mitigation techniques, lowering the chance of defaults and enhancing overall loan portfolio health. Real-time market trend monitoring improves the flexibility of risk management measures in response to changing economic conditions. This can be an AI use cases in the lending industry.

-

Upstart, an online loan company, assesses applicants' creditworthiness using machine learning algorithms. Upstart can identify possible hazards and make data-driven loan choices using predictive analytics. The platform promises to have lower default rates by utilizing AI in risk evaluation.

3. Chatbots for Customer Service and Onboarding

-

AI-powered chatbots have transformed the loan industry's customer care and onboarding processes. These clever virtual assistants respond to consumer concerns instantly, expedite application procedures, and give personalized counsel. Consequently, customers have a better experience, shorter response times, and higher operational efficiency. Chatbots may also help with client onboarding by automating document verification, identity checks, and other KYC (Know Your client) processes, assuring compliance while speeding up the onboarding process. this can be an AI use cases in the lending industry.

-

Chatbots are used by Ally Bank, a digital financial services firm, to improve client interactions. Ally Assist, Ally's chatbot, provides consumers with account information, transaction details, and other questions. By giving fast advice and instruction, the chatbot contributes to a smooth onboarding experience.

4. Fraud Detection and Prevention

-

AI has emerged as a strong ally in the battle against loan fraud. Machine learning algorithms can analyze transaction patterns in real-time and discover abnormalities suggestive of fraudulent activity. Whether it's identity theft, loan stacking, or other fraudulent behaviors, AI's capacity to scan big datasets enables rapid detection and prevention of fraudulent activities. This protects lenders from financial losses and improves overall industry security. This can be an AI use cases in the lending industry.

-

Featurespace, a behavioural analytics firm, specialises in AI-based fraud prevention. Their ARICTM technology analyses individual behavior patterns and detects abnormalities in real-time using machine learning. As a result, Featurespace assists financial institutions in proactively preventing fraudulent actions, protecting both lenders and borrowers.

5. Personalized Loan Recommendations

-

AI-powered recommendation systems are revolutionizing how lenders engage with their consumers. AI can create personalized loan recommendations by analyzing individual financial behaviors, spending habits, and preferences. This guarantees that clients receive offers personalized to their unique needs, leading to better-informed decision-making. Personalization boosts client happiness and loyalty, establishing long-term connections between lenders and borrowers. This can be an AI use cases in the lending industry.

-

LendingClub, a peer-to-peer lending platform, personalizes loan offerings with AI-driven recommendation algorithms. LendingClub tailors loan suggestions based on borrowers' financial behaviors and preferences, ensuring that borrowers receive offers tailored to their unique requirements and financial conditions.

6. Automated Loan Underwriting

-

By automating the study of borrower data, AI streamlines the loan underwriting process. To establish creditworthiness, machine learning algorithms use a variety of characteristics such as income, job history, and debt levels. Automated underwriting expedites loan approvals and lowers the possibility of human bias in decision-making, ensuring fair and consistent lending procedures. This can be an AI use cases in the lending industry.

-

Blend, a digital lending platform, uses artificial intelligence to streamline the loan underwriting process. Their software analyzes different borrower data points, expediting the creditworthiness evaluation. This automation expedites the loan approval procedure, making it more efficient and uniform for both lenders and borrowers.

7. Dynamic Interest Rate Optimization

-

AI allows lenders to optimize interest rates dynamically based on real-time market conditions, borrower credit profiles, and risk assessments. This responsive method guarantees that interest rates align with current economic developments and borrower-specific characteristics, resulting in a more adaptive and competitive lending market. This can be an AI use cases in the lending industry.

-

PeerIQ, a financial data analytics firm, uses artificial intelligence to optimize interest rates in the peer-to-peer lending industry. PeerIQ improves the competitiveness of lending platforms and ensures rates fit with the current economic environment by dynamically modifying interest rates depending on market conditions, borrower profiles, and risk assessments.

Conclusion

- As we go around the lending landscape, it becomes clear that AI is more than just a technological development; it is a catalyst for a fundamental revolution. We've revealed the tremendous influence of AI Use Cases In the Lending Industry by utilizing the before-and-after bridge content strategy structure. From manual underwriting to automated decision-making, fixed interest rates to dynamic pricing models, reactive fraud detection to proactive risk management, AI is ushering in a new era of lending efficiency, accuracy, and justice. Embracing these disruptive technologies is not simply a choice; it is a strategic need for those who want to stay ahead of the ever-changing lending market.

How Digiqt will help you to adapt AI in your company.

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.