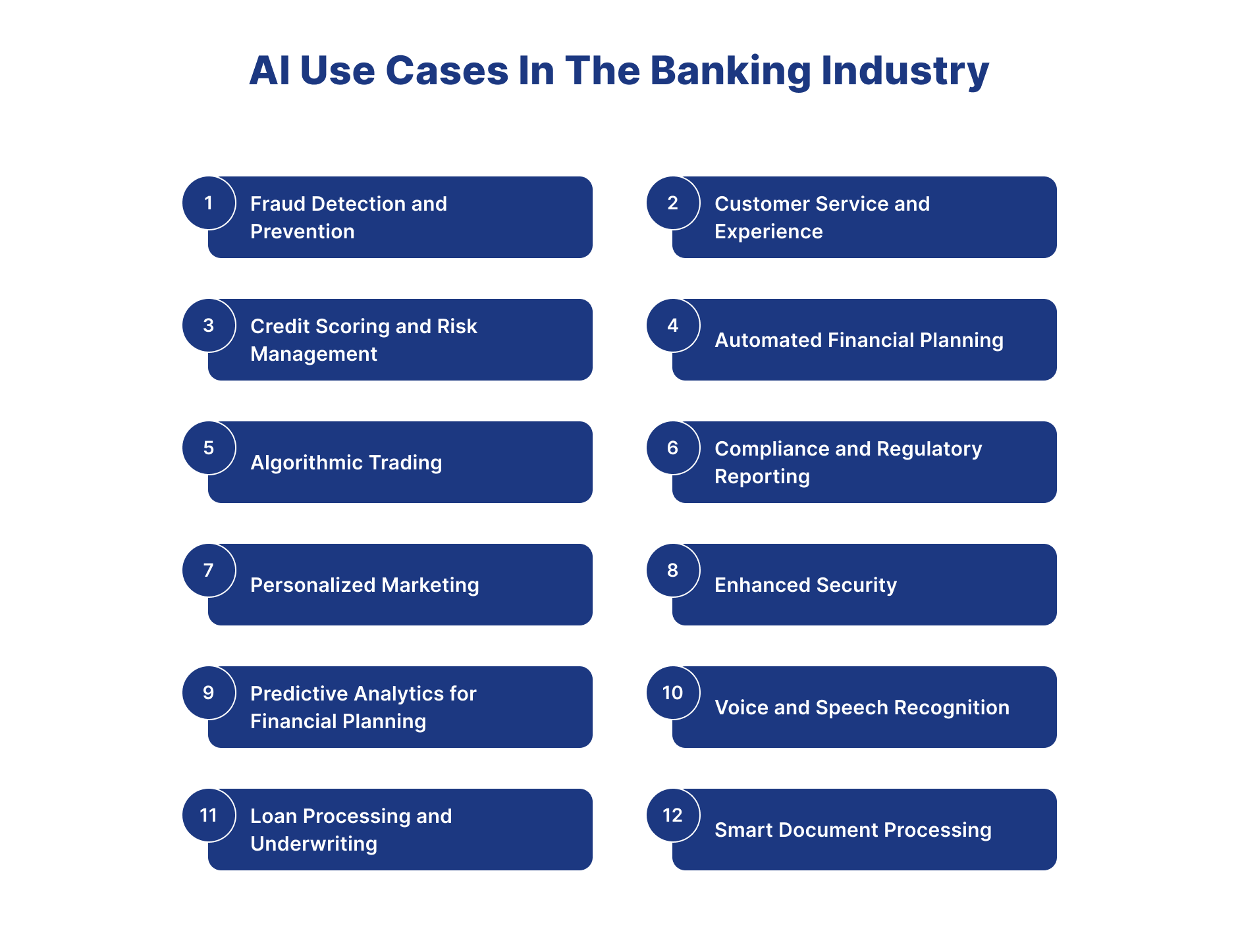

AI Use Cases In The Banking Industry: 12 Use Cases Of Implementing AI To Transform The Banking Sector

Some of the AI use cases in the banking industry are personalized client experiences, expedited processes, and improved risk management in the banking business.

Introduction

- Artificial intelligence (AI) is transforming several sectors, including the banking industry. AI is revolutionizing traditional banking processes with its capacity to analyze massive volumes of data, discover trends, and make autonomous choices. Some of the AI use cases in the banking industry are personalized client experiences, expedited processes, increased fraud detection, and improved risk management in the banking business. AI is transforming banking services and operations as we know them, from chatbots and virtual assistants to automated loan underwriting and fraud protection systems. This article examines some of the most important AI use cases in the banking industry and the benefits and problems involved with their adoption.

AI Use Cases In The Banking Industry

1.Fraud Detection and Prevention:

-

AI algorithms are critical in spotting strange patterns and fraudulent activity in real-time. Machine learning algorithms analyze massive volumes of transaction data, allowing banks to detect and block fraudulent transactions in real time. This not only protects consumers' financial interests but also assists banks in maintaining a secure environment. This can be an AI use case in the banking industry.

-

Wells Fargo employs artificial intelligence systems to detect and prevent fraudulent activity. The bank uses machine learning models to analyze transaction patterns and identify real-time odd actions. This proactive strategy aids in the protection of its clients' financial interests.

2.Customer Service and Experience:

-

Chatbots and virtual assistants driven by AI have changed customer service in the banking industry. These sophisticated technologies can respond to consumer concerns instantly, assist with account-related operations, and even provide personalized financial advice. This increases customer happiness and speeds up routine issue resolution, allowing human agents to focus on more complicated tasks. This can be an AI use cases in the banking industry.

-

Erica, Bank of America's virtual assistant, leverages AI to present consumers with personalized financial information. Erica aids with things such as checking account balances, paying payments, and providing budgeting advice, boosting the entire customer experience through her availability 24 hours a day, seven days a week.

3.Credit Scoring and Risk Management:

-

AI algorithms analyze many data points to determine creditworthiness more precisely than traditional credit scoring methods. This allows banks to make more educated loan decisions, which reduces the chance of default. AI-powered risk management algorithms constantly adapt to shifting economic situations, allowing banks to handle financial uncertainty more efficiently. This can be an AI use cases in the banking industry.

-

JP Morgan Chase employs artificial intelligence in its credit scoring and risk management operations. The bank uses machine learning algorithms to assess creditworthiness more precisely, allowing for better-informed lending choices and risk management.

4.Automated Financial Planning:

-

Customers may create personalized financial plans using AI-powered tools that analyze their spending patterns, income, and long-term objectives. These tools offer essential insights and advice for budgeting, saving, and investing, assisting individuals in making educated financial decisions that align with their goals. This can be an AI use cases in the banking industry.

-

Wealthfront, a robo-advisor platform, uses artificial intelligence algorithms to build personalized investment portfolios based on individual financial objectives, risk tolerance, and time horizons. The platform constantly adjusts the portfolio to reflect changing market circumstances and the client's financial status.

5.Algorithmic Trading:

-

AI-driven algorithms are used in algorithmic trading, allowing banks to execute transactions rapidly and make data-driven investment choices. Machine learning models analyze market patterns, news, and other pertinent data to optimize trading strategies with the purpose of increasing earnings while decreasing hazards This can be an AI use cases in the banking industry.

-

Citadel Securities, a worldwide financial company, employs artificial intelligence algorithms for high-frequency trading. These algorithms analyze market data at breakneck speed, making split-second trading choices to exploit market inefficiencies.

6.Compliance and Regulatory Reporting:

-

Numerous rules and compliance requirements apply to the banking industry. AI aids in automating transaction monitoring, ensuring that they comply with regulatory rules. Furthermore, AI technologies help prepare regulatory reports, lowering the chance of mistakes and assuring compliance with changing financial requirements. This can be an AI use cases in the banking industry.

-

Promontory Financial Group, a financial services consulting business, employs artificial intelligence (AI) techniques to help banks navigate complicated regulatory requirements. These solutions automate transaction monitoring and maintain compliance with changing financial requirements.

7.Personalized Marketing:

-

Artificial intelligence analyses client data to generate personalized marketing efforts. Banks may provide customized products and services by knowing individual preferences and behavior, increasing cross-selling and upselling potential. This not only benefits the bank financially, but it also improves the whole client experience. This can be an AI use cases in the banking industry.

-

DBS Bank in Singapore uses artificial intelligence for personalized marketing initiatives. The bank analyzes Customer data to adapt promotions and offers, boosting the relevancy of marketing materials and developing a closer connection with clients.

8.Enhanced Security:

-

AI is critical in boosting cybersecurity safeguards.It identifies and responds to security hazards in the environment real-time, protecting necessary financial data. Face recognition and fingerprint scanning are two examples of biometric authentication, offers extra protection to bank accounts, guaranteeing that only authorized persons have access to them. This can be an AI use cases in the banking industry.

-

To improve the security of its mobile banking app, Wells Fargo employs biometric identification, such as voice and face recognition. This guarantees that only approved people have access sensitive financial information via these channels.

9.Predictive Analytics for Financial Planning:

-

Artificial intelligence algorithms use predictive analytics to examine market trends and economic data, assisting in long-term financial planning. These technologies assist banks and their clients in making better-educated decisions regarding investments, portfolio diversification, and asset management by analyzing historical data and spotting trends. This can be an AI use cases in the banking industry.

-

Betterment, a robo-advisor platform, forecasts market movements and optimizes portfolio allocations using predictive analytics. This enables Betterment to provide clients with proactive investing plans that align with their financial objectives.

10.Voice and Speech Recognition:

-

Voice recognition technology powered by AI improves the security of financial transactions. Voice biometrics give extra protection, guaranteeing that only authorized users may access sensitive information or perform financial transactions using voice-activated interfaces. This not only improves user convenience but also boosts overall security measures. This can be an AI use cases in the banking industry.

-

For its clients to use telephone banking services, HSBC used voice biometrics. Customers may add extra security to their accounts by securely authenticating themselves by uttering a passphrase.

11.Loan Processing and Underwriting:

- AI automates numerous underwriting procedures by automating the loan application and approval process. Machine learning models evaluate borrower risk, credit histories, and financial records, speeding decision-making. Consequently, approvals are speedier, and the loan procedure is more efficient. This can be an AI use cases in the banking industry.

- Quicken Loans uses artificial intelligence in its mortgage underwriting process. The Rocket Mortgage platform analyses financial data and streamlines the approval process, lowering the time necessary for loan processing.

12.Smart Document Processing:

-

AI-powered OCR and NLP technologies enable banks to automate extracting and analyzing information from massive volumes of unstructured data. This is especially useful for jobs like document verification, compliance checks, and form processing since it reduces manual work while enhancing accuracy. This can be an AI use cases in the banking industry.

-

ING Bank uses optical character recognition (OCR) technology to automate the extraction of information from documents. This simplifies procedures like KYC (Know Your Customer) checks, making onboarding more efficient while assuring regulatory compliance.

Conclusion

- In conclusion, incorporating AI is a multifaceted path paved with many AI use cases in the banking industry. These applications enhance efficiency and security and pave the way for a more personalized client experience. The possibilities are vast and ever-evolving, from fraud detection and automated risk assessment to intelligent chatbots and personalized financial advice. As technology advances, the synergy between AI and banking will undoubtedly continue to blossom, giving rise to even more inventive solutions that will significantly reshape the financial landscape.

How digit will help to implement ai in your company

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.